Payroll Giving: Drive Employee Donations For Your Cause

According to America’s Charities, nonprofits raise about $5 billion from workplace giving each year. These funds are crucial in enabling charitable organizations to pursue their missions.

With so much donation revenue available through this channel, wouldn’t it be nice if there was a way to streamline these contributions? That way, companies could better manage them, donors would be more inclined to contribute, and nonprofits would ultimately earn more for their causes.

Enter payroll giving. This form of workplace giving makes donating as easy as possible for employees. In this guide, we’ll review what payroll giving is and just how beneficial it is for companies, donors, and nonprofits alike.

What is payroll giving?

Payroll giving, also known as automatic payroll deductions, allows employees to contribute to nonprofits right from their paychecks. Since these deductions come out of employees’ paychecks automatically, it’s an easy set-it-and-forget-it way to give back. In most cases, these contributions are a percentage of the employee’s pay, but corporations that use CSR software with employee self-service tools may allow team members to adjust their contributions as they please.

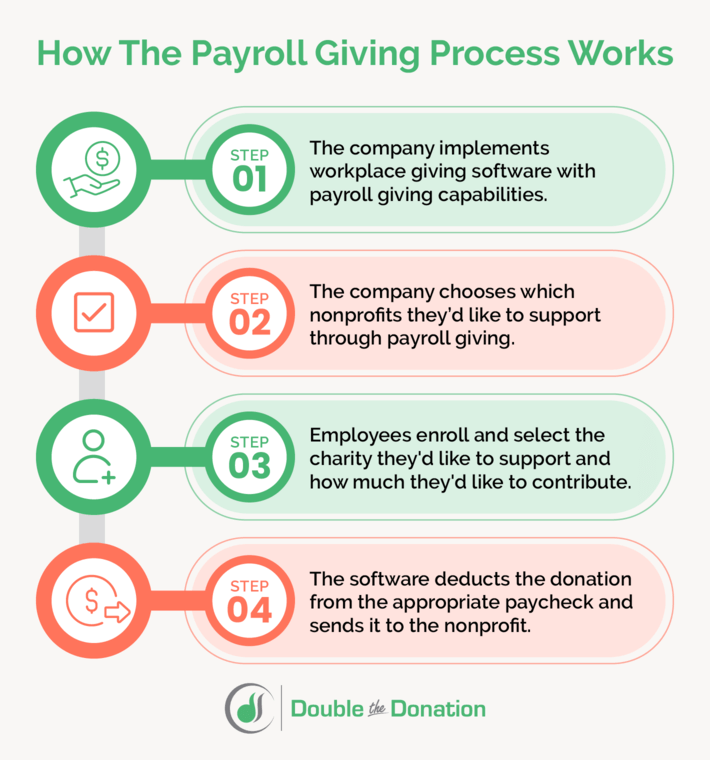

How does payroll giving work?

With the help of workplace giving software, payroll giving simplifies the donation process. These steps illustrate how payroll giving works:

- The company implements workplace giving software with payroll giving capabilities.

- The company chooses which nonprofits they’d like to support through payroll giving.

- Employees enroll and select the charity they’d like to support and how much they’d like to contribute.

- The software deducts the donation like any other deduction—such as a 401K contribution or healthcare premium—and sends it to the nonprofit.

While most payroll deductions are pre-tax, payroll giving contributions are after-tax deductions. As a result, employees can claim these donations as deductible when they file their personal taxes. Companies that offer payroll giving should reflect employees’ contributions in their W2s.

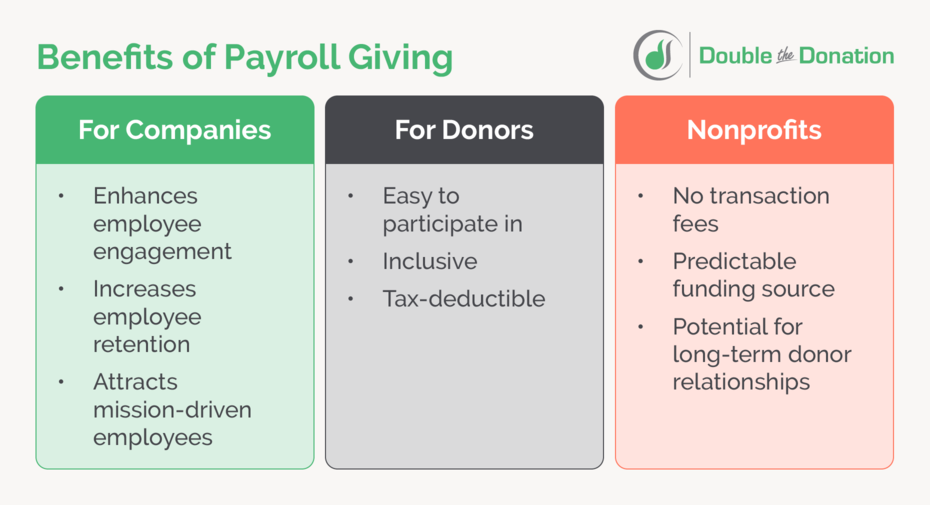

What are the benefits of payroll giving?

While it’s clear that payroll giving benefits nonprofits since they receive the resulting donations, this form of workplace giving is also beneficial for participating companies and donors. Let’s dive into the benefits of payroll giving for each group.

Benefits of Payroll Giving for Companies

Not only is payroll giving easy for companies to manage, but it also offers a variety of other workplace benefits for companies. Payroll giving helps companies to:

- Engage employees. Workplace giving methods such as payroll giving increase employee engagement. When employees feel that they are working together with their employer to make the world a better place, they’re more likely to find meaning in their roles and stay actively engaged in the workplace.

- Keep employees around. Employees engaged in workplace giving have higher retention rates. In fact, employees who participate in workplace giving have 75% longer tenures with their companies than those who don’t.

- Attract mission-driven employees. Payroll giving helps companies recruit employees who share their values and want to make a difference. Studies show that 71% of employees want to work at a company that gives back to charitable causes through philanthropy and volunteering. By offering payroll giving and promoting it during the hiring process, companies can attract mission-driven team applicants.

When companies offer payroll giving, they demonstrate their commitment to corporate social responsibility (CSR) by helping employees find reputable nonprofits to contribute to and facilitating the giving process. As a result, they’ll build a workforce of like-minded, engaged employees who will stay long-term.

Benefits of Payroll Giving for Donors

There are so many different ways donors can contribute to their nonprofits of choice, so what makes payroll giving stand out? Payroll giving is an excellent donation method for donors because it’s:

- Easy to participate in. Once donors enroll in payroll giving, they’re set to continue contributing indefinitely. The automatic donations make it extremely easy for donors to participate without taking time out of their busy schedules to make repeat gifts.

- Inclusive. While these days nonprofits accept donations in cash, credit, PayPal, Apple Pay, Venmo, and more, not all employees have these payment methods at their disposal. However, all employees receive a paycheck, so payroll giving allows them to make a difference.

- Tax-deductible. As mentioned before, payroll deductions come out of donors’ after-tax earnings, making these contributions tax-deductible. Donors can write off these costs and will owe less when they file their taxes.

Additionally, if donors don’t have the means to contribute a large sum at once, payroll giving enables them to break up their donation into smaller, more manageable amounts that they can gift to nonprofits on a recurring basis.

Benefits of Payroll Giving for Nonprofits

Payroll giving is one of many ways for nonprofits to generate donation revenue, so it benefits them by simply providing them with more funds. However, there are some less obvious benefits of payroll giving for nonprofits as well, including:

- No transaction fees. Traditional online donation methods may require payment processing fees that lessen the value of each donation. Since payroll giving comes right from donors’ paychecks, there are no transaction fees, meaning the entire donation amount goes directly to the nonprofit.

- Predictable funding source. Payroll contributions are a form of pledged donations. Nonprofits can plan for these gifts in advance, allowing them to better allocate their budgets.

- Potential for long-term donor relationships. Donors who contribute to nonprofits through payroll giving do so on a recurring basis. Charitable organizations can identify regular payroll giving participants and establish long-lasting relationships with them.

Nonprofits can also analyze their donor data to determine which employers are most frequent among their payroll givers. Then, they can reach out to these companies to forge corporate partnerships that benefit both parties.

What are some companies that offer payroll giving?

Because payroll giving programs are facilitated by a donor’s employing company, it’s a good idea to familiarize yourself with top businesses offering the opportunity.

Here are some leading employers with payroll giving programs. Do your donors work for these companies?

- Costco Wholesale

- JPMorgan Chase

- CVS Health

- 3M Company

- Warner Bros. Discovery

- Eli Lilly and Company

- Navy Federal Credit Union

- Amazon.com Inc.

- Advocate Aurora Health

- Close Brothers

- Gray TV

- Adobe Inc.

- Brit Insurance

Keep in mind, however, that this list is just the tip of the iceberg. There are a ton more businesses offering payroll giving initiatives, and you can encourage your donors to check with their employers directly, too!

How can you increase payroll giving at your org?

Focusing on payroll giving opportunities can lead to a substantial increase in donations for your organization. Doing so effectively involves a combination of strategic communication, proactive arrangements, and ongoing engagement efforts.

Here are several actionable steps your team can take to boost participation in the programs:

Drive awareness of payroll giving opportunities across your audience. To increase participation in payroll giving, it’s essential to first ensure that your audience is aware of the opportunity. This should involve regularly sharing information about payroll giving through newsletters, social media, your website, and more.

Register as an eligible cause for companies’ payroll giving systems. For your nonprofit to benefit from payroll giving, it’s crucial to be listed as an eligible cause within companies’ payroll giving systems. To do so, start by researching CSR platforms and seeing how your organization can register. This guide provides step-by-step instructions on how you can apply for a free nonprofit account!

Plus, be prepared to provide any necessary documentation, such as proof of 501(c)(3) status, financial records, or impact reports, to meet the requirements of corporate partners.

Incentivize participation among qualifying supporters. To boost payroll giving participation, consider offering incentives to encourage more supporters to sign up. This could include recognition for payroll givers, such as listing their names on your website or in your annual reports or providing exclusive updates on the impact of their donations. You can even consider offering exclusive events, webinars, or other perks that show appreciation and make the act of giving more rewarding. By marketing the opportunities well, you can increase program engagement and participation.

Thank payroll giving donors for their generous contributions. Expressing gratitude to your payroll giving donors is critical for retaining their support and encouraging long-term participation. This can include personalized thank yous, such as handwritten notes or emails to acknowledge their contributions. Be sure to mention the specific impact their donations are making and how they align with your nonprofit’s mission.

How do payroll giving and matching gifts connect?

Matching gifts are a type of corporate giving program where a company agrees to match their employees’ donations to nonprofit organizations, usually at a 1:1 ratio. By implementing matching gifts, companies can encourage their employees to donate to their favorite causes, with 84% of matching gift survey participants saying they’re more likely to donate if a match is offered.

When companies apply matching gifts to payroll contributions, they can amplify the impact of their employees’ donations and allow nonprofits to earn even more for their causes. Some workplace giving platforms let companies apply matching directly through the software. Donors can also use a matching gift database to research their matching gift eligibility and fill out a matching gift request form to send to their employers.

Check out how our matching gift software, 360MatchPro, helps organizations boost donation revenue:

By combining the efficiency of payroll giving and matching gift software, donors can easily make an impact on their favorite causes and help nonprofits increase their revenue. Payroll giving and matching gifts go hand in hand to expand companies’ CSR efforts, allow donors to make a greater impact with the same donation amounts, and enable nonprofits to earn the funds they need to support their beneficiaries.

Final Thoughts and Additional Resources

When it comes to corporate philanthropy, payroll giving stands out due to its extreme efficiency in nature. That means it’s easier for companies to manage the programs, donors to participate in them, and nonprofits to access necessary funds. The simplicity of payroll giving removes common barriers to engagement, allowing for seamless integration into the daily operations of both businesses and nonprofits.

As a fundraising professional, understanding and leveraging the power of payroll giving is crucial. The more you target this opportunity, the more payroll giving funds you can expect to receive. By actively promoting payroll giving opportunities and educating donors about its ease and impact, you can tap into a consistent, reliable source of funding. Good luck!

To learn more about payroll and other forms of workplace giving, check out these resources:

- 20+ Matching Gift & Payroll Giving Companies: Leaders in Corporate Giving. Payroll giving and matching gifts often go hand in hand. Browse this list of top matching gift companies, many of which offer powerful payroll giving opportunities for their employees.

- Winning Workplace Giving Strategies & How to Leverage Them. Find out everything there is to know about leading workplace giving programs in this guide! Uncover insights on matching gifts, volunteer incentives, payroll giving, and more.

- Top Corporate Giving and Matching Gift Statistics to Know. Get familiar with the corporate philanthropy landscape! Uncover inspiring matching gift and corporate giving statistics to become better acquainted with the opportunity in this blog post.